What is Asset Investment Planning (AIP)?

The energy sector is undergoing significant transformation. Utility companies are confronted with the challenge of managing aging infrastructure that requires extensive refurbishment or replacement. This is happening alongside a global shift in policy towards more efficient and sustainable energy systems. Ignoring these factors could greatly affect overall grid stability, customer satisfaction, and compliance with evolving regulatory and environmental standards.

Faced with these challenges, utilities are struggling with limited resources and a range of stakeholders, both internal and external, who have interests in various projects including new developments, refurbishments, legal regulations, and network digitalization.

Recognizing the need for data-driven decision-making in investment projects, companies are turning to AIP solutions. These solutions provide powerful and intelligent support that enables companies to plan and manage investments, optimizing benefits, costs, and risks to achieve high-value returns.

IPS has been identified as a Representative Vendor in the 2022 Gartner® Market Guide for AIP Solutions for Energy and Utilities. Access the report to explore AIP solution recommendations and key capabilities in more detail.

AIP vs Asset Performance Management (APM)

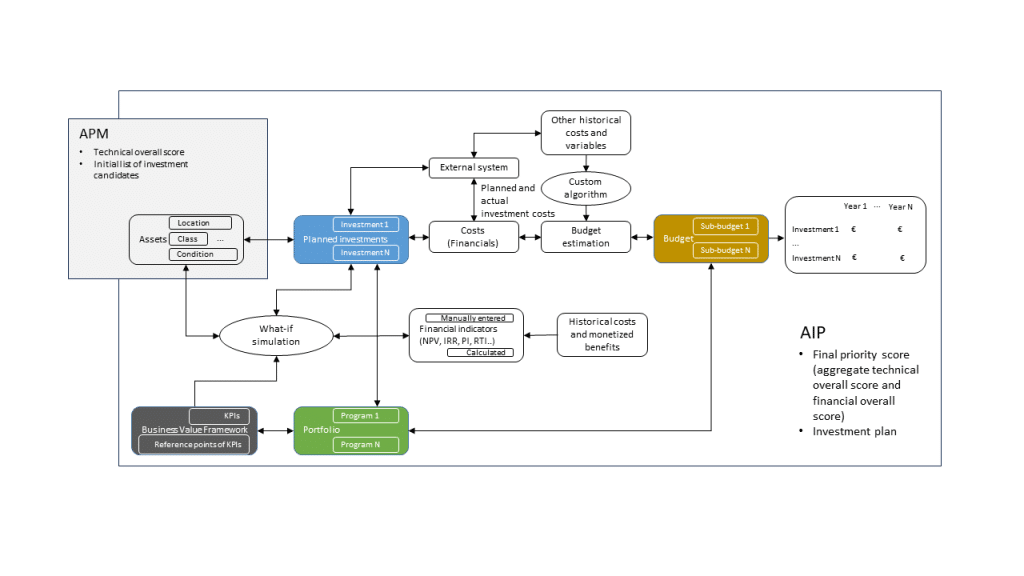

AIP differs from APM and Enterprise Asset Management by focusing on longer-term strategic planning, specifically aimed at optimizing budgets. In contrast, APM focuses on evaluating asset health, importance, probability, and consequences of failures, ensuring accurate and measurable operational reliability of assets.

Every AIP investment and scenario is evaluated based on APM results and strategic considerations, such as budgetary constraints and regulatory requirements.

AIP role in digital ecosystem

An AIP solution should utilize asset data collected from systems like NMM, APM, EAM, GIS, and OMS to predict areas of need. This, coupled with budgeting opportunities, enables the identification of the most viable investment options within a predetermined timeframe, typically spanning a year or longer.

On the flip side, AIP systems serve as the primary source of information and should be seamlessly integrated into supply chain management processes (SCM) and enterprise resource planning (ERP) systems.

During periods of supply and demand shocks such as pandemics or conflicts, as well as times of inflation, it is imperative for companies to streamline and effectively execute SCM and distribution processes to mitigate risks. AIP systems play a pivotal role in providing valuable insights within such scenarios.

AIP – what to look for?

Several factors should be considered before implementing an AIP solution, such as:

- The real value of existing in-house solutions and their integration (in)capability within the digital twin represented by EAM, APM and NMM.

- Whether to base AIP on outdated statistical data or on actual asset risk and planning data.

- Ensuring seamless integration between AIP, APM, EAM, and operational planning tools like NMM as a source for investment planning decisions.

- Methods to support and enhance decision-making by optimizing the benefits, costs, and risks associated with high-value assets.

IPS®AIP Asset Investment Planning can enhance the value of investment decisions and is a proven approach for complex business challenges. Contact us if you want to schedule an AIP demo.